🔍 GST Turnover Mismatch with Income Tax: Why Notices Are Increasing & How to Stay Safe

Businesses across India are receiving GST scrutiny notices where the department highlights a difference between turnover reported in GST Returns and Income Tax Returns. This has become one of the most frequent issues in 2024–25 as the government moves towards full data integration across GST, Income Tax, MCA and banking systems.

At Taxtip.in, we are helping many businesses respond to these notices with accurate reconciliations and compliant documentation. Here is a clear, simple guide for taxpayers.

🚨 Why the Department is Issuing These Notices

The GST system is now linked with:

- ITR filings

- AIS & 26AS

- TDS returns

- PAN-based turnover data

- Bank statements

- E-invoice portals

Even a small variance between GST turnover and ITR disclosures triggers automated flags, followed by:

- ASMT-10 (Scrutiny)

- DRC-01A (Pre-show cause notice)

- Summons or audit proceedings

The purpose is to verify whether turnover has been under-reported or whether the mismatch is simply due to accounting differences.

📌 Common Reasons for Turnover Mismatch

Most differences are genuine and arise from:

1. Other Income Included in ITR but Not Under GST

- Examples:

- FD interest

- Rent income

- Scrap sale

- Capital receipts

- Duty credit / other indirect income

These are not taxable under GST but increase turnover in ITR.

2. Accounting Method Differences

Books follow accrual basis

GST follows invoice/date of supply basis

This creates timing differences for:

- year-end billing

- advance receipts

- credit notes

- sales returns

3. GSTR-1 vs GSTR-3B Differences

If monthly returns were not aligned, it reflects as mismatch in annual return and income tax turnover.

4. Exempt / Non-GST Supplies Not Disclosed in GST

Turnover reported in ITR includes all income, but GST returns may include only taxable supplies.

📊 How Taxpayers Should Respond

A strong reply must be backed by clear reconciliation and documentary proof.

Here’s the standard structure we follow at Taxtip.in:

✔ Step 1: Start with GST Turnover

- Turnover as per GSTR-1

- Turnover as per GSTR-3B

- Figures as per Annual Return (GSTR-9)

✔ Step 2: Add Non-GST Income

Attach supporting documents such as bank statements, ledger copies, rent agreements, FD certificates, etc.

✔ Step 3: Adjust Year-End Accounting Items

Include credit notes, advances, or timing differences.

✔ Step 4: Explain Differences in Simple Language

A concise, factual explanation helps close the scrutiny quickly.

✔ Step 5: Submit a Professional Reply

Attach your reconciliation, financial statements, and proof of non-GST income.

When done properly, most cases get resolved without escalation.

⭐ Example: How Reconciliation Resolved a ₹14.2 Lakh Difference

GST turnover was lower than ITR turnover by ₹14.20 lakh.

Breakup:

- Interest income (non-GST): ₹8.4 lakh

- Scrap income (non-GST): ₹2.6 lakh

- Sale of fixed assets: ₹1.5 lakh

- Misc. accounting adjustments: ₹1.7 lakh

All amounts were legitimate and outside GST.

A proper explanation closed the scrutiny with no tax demand.

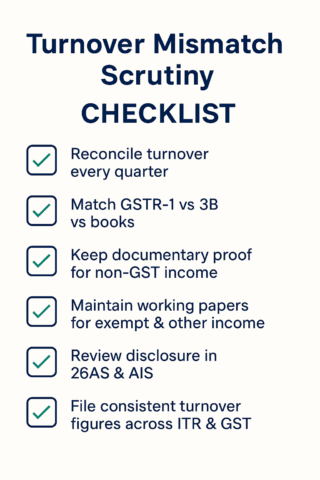

🧾 Client-Friendly Checklist

Here is a quick compliance checklist for every business:

- Reconcile GST & ITR turnover every quarter

- Match GSTR-1 with GSTR-3B and books

- Maintain proof for non-GST income

- Keep working papers for exempt & other income

- Review 26AS & AIS disclosures

Ensure consistent figures across GST & Income Tax

Following this process helps avoid scrutiny and strengthens your compliance rating.

🛡️ Need Help With a GST Notice?

Taxtip.in provides expert drafting, reconciliation and representation services for all GST notices, including turnover mismatch scrutiny.

Whether the notice is for ASMT-10, DRC-01A, audit or assessment — we ensure timely, accurate and professional replies.

📞 Contact: 🌐 www.taxtip.in